About Atlantic Family Office Alliance (AFOA)

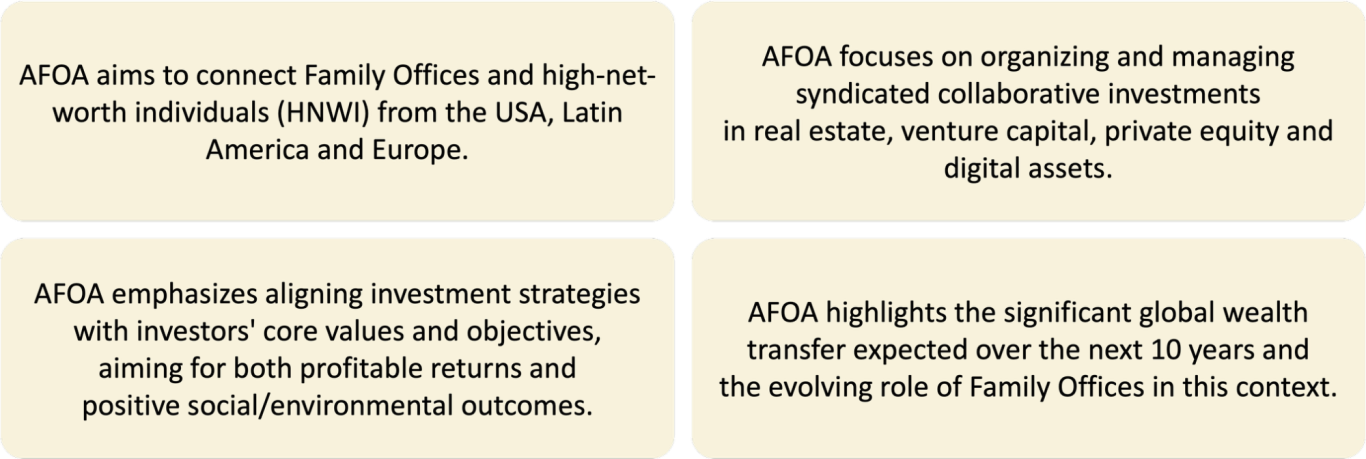

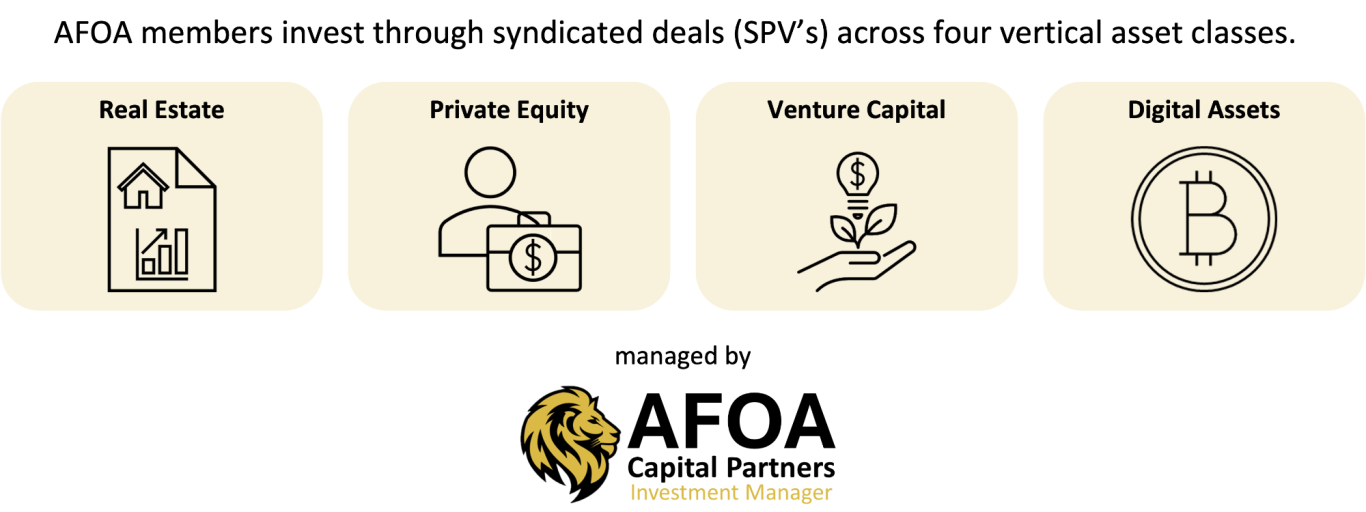

The Atlantic Family Office Alliance (AFOA) connects Family Offices and high-net-worth individuals (HNWI) across the United States, Latin America, and Europe. We specialize in organizing and managing syndicated collaborative club investments in Venture Capital, Private Equity, Real Estate, and Digital Assets like crypto. Our members become part of an international community that shares advice, resources, and investment opportunities, enriching not only their lives but also those of family generations to come.

Our Vision and Mission

As a diversified investment alliance, AFOA supports Family Offices, and HNWI who are seeking to build their wealth and maximize their impact in the world. We provide an opportunity to collaborate on investments in assets classes like Venture Capital, Private Equity, Real Estate and Digital Asset (like Crypto) and support the founders of our member's portfolio companies with capital & advise for global scaling and expansion.

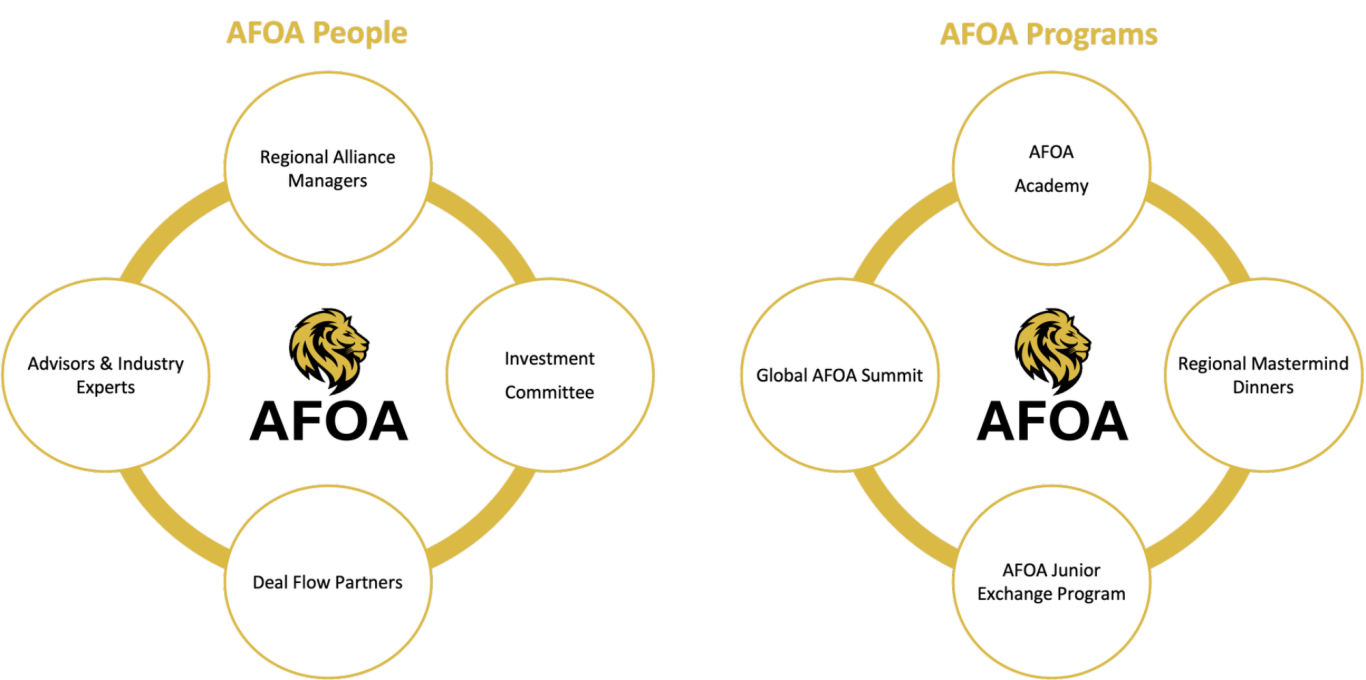

As an alliance of equals, we will focus our activities on bundling our global network of capital, investors, mentors, and advisors. In the Family Office context, it truly takes a caring, multidisciplinary team of professional advisors to holistically serve and support the family and their Family Office. By doing this we identify and create unique opportunities based on real insights, bundling the firepower and expertise from our global network. We create alpha not by inventing new strategies, but by excelling in executing selected strategies in the above asset classes including a hands-on approach towards portfolio management after Closing.

Where do we invest?

AFOA proudly highlights our range of investment services tailored for Family Offices and HNWIs. Our international community is built on shared expertise, resources, and a commitment to enriching the lives of our members and future generations.

Managing Partners & Founders

Our founders team consists of highly qualified and motivated professionals, who are all experts in their field. With many years of experience as entrepreneurs and corporate executives, and as investors in venture capital, private equity, real estate & digital assets, they have the expertise to provide comprehensive, first-rate services to our Family Office and HNWI members.

Dieter Kondek

Managing Partner

Dieter possesses over 40 years of distinguished experience as an entrepreneur, investor, family office connector, and senior executive within the technology and real estate sectors.

He has co-founded, financed, and successfully exited—one via initial public offering—multiple thriving technology enterprises. His professional tenure includes serving as CEO, Board Member, and in various senior leadership capacities at both venture capital-backed and publicly traded companies. In 2003, he established DKFL Capital LLC, an investment and consulting firm based in Florida. In 2018, he co-founded GBV, a Blockchain Venture Capital Fund with $50 million in assets under management, strategically invested across 43 portfolio companies.

Dieter has held senior leadership roles, including CEO positions, in both public and private organizations, notably IBM, Dell, and Tech Data.

Dr. Michael Spaeth

Managing Partner

Michael possesses over 20 years of extensive expertise in Mergers and Acquisitions, Private Equity, Corporate Finance, and Family Office operations. His robust technical acumen in executing transactions and fostering long-term commercial viability has led him to manage and invest in companies spanning diverse sectors.

Most recently, Michael co-founded Equitas GmbH, a Corporate Finance and Consulting firm based in Germany, and currently serves as a Member of the Board of Advisors at 361Firm.

Throughout his distinguished career, he has occupied pivotal leadership roles, including CEO, CFO, CIO, and Board Member, at prominent public and private enterprises such as Arthur Andersen, Deutsche Industriebank AG, PwC, and Siemens.

Dr. Andreas Jerschensky

Managing Partner

Andreas is a highly accomplished executive with over 20 years of experience in effectively executing growth strategies informed by a comprehensive understanding of technology and robust Corporate Finance expertise. He possesses a proven history of executing transformative merger and acquisition transactions, including the establishment of a Corporate Venture unit.

Currently, he is a member of the executive management team of the Landa Group and actively serves on the boards of the portfolio companies under Landa Ventures, namely Novelsat and Arroweye Solutions.

Throughout his career, Andreas has held critical executive and leadership roles within prestigious organizations such as ALTANA, Deutsche Post/DHL Group, Evonik, and EY/Arthur Andersen.

Join Our Community

By joining the Atlantic Family Office Alliance, you gain access to unique investment projects and off-market Real Estate deals, in a network of like-minded individuals caring for their family's future. Together, we will unlock the potential of your investments.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.